Policyholders

trust Grange and Integrity with their insurance needs

830,000+

Our story began in 1935. Today, we offer customizable auto, home, life and business insurance products, serving customers across 13 states. Because we firmly believe our customers are best served through the trusted choice and counsel of independent agents, Grange and our affiliate, Integrity Insurance, sell exclusively through independent agents.

80+ years of trust

and protection

13 States

Our affiliation with Integrity Insurance is 14 years strong. Together, we have greater financial strength and market presence. And, we can deliver even more value to agents and policyholders. In 2015, Integrity hit an all-time high for policies and enjoyed its fourth straight year of profitability and growth.

grange and integrity,

stronger together

Independent agents are part of our DNA. They’re valued partners and the cornerstone of our business. It’s these relationships that set us apart and drive us to be the best at what we do.

building true partnership

Independent

Agents

proudly partner

with Grange and Integrity

5,000+

A

rating

from A.M. Best

(EXCELLENT)

With an “A” Excellent rating from A.M. Best spanning 50 years and $2 billion in assets, Grange has the strength and stability of a larger insurance carrier but with the local, personalized service of a small company.

financial strength

and stability

“The world is changing.

Consumers are changing.

We as an industry must be changing, too.”

A Message from the President & CEO

For more than 80 years, Grange has delivered on our promise to provide high quality protection to our policyholders while being a stable, predictable partner to our agents. Over the past year, we continued to deliver on that foundational promise but with an eye to the future, too.

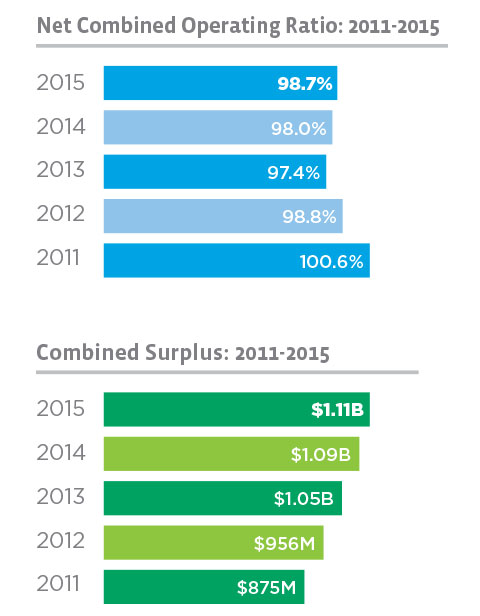

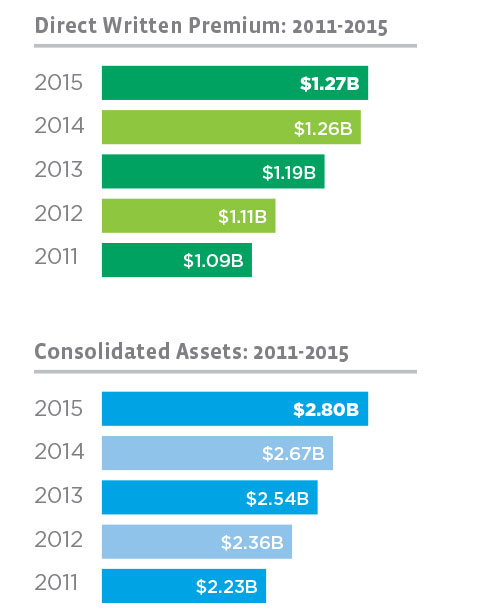

The products, services and people we invest in year after year each play a critical role in our continued growth and success. In 2015, together with our agent partners, we generated an all-time high of $1.3 billion in premium and delivered an enterprise net combined ratio (NCOR) of 98.7%. In addition, we achieved record year-end surplus of $1.1 billion. With focus, we achieved a profitable year for the business despite our industry’s challenging economic and competitive environment.

Across our business segments — Personal Lines, Commercial Lines and Grange Life — we brought new, competitive products to market to fuel our agents’ business growth while meeting the full spectrum of insurance needs for policyholders. We continued to maximize our relationship with our affiliate, Integrity Insurance, to better serve our agent and customer base throughout our 13-state footprint.

We hit several big milestones in our work to deliver exceptional service and Ease of Doing Business®. We introduced a redesigned, mobile-friendly website that offers an improved experience for our policyholders. And we continue to enhance our quoting platform GAINWeb® for agents, which is consistently recognized as one of the easiest to use in the industry.

When considering the impact of technology on the broader marketplace, though, we have to acknowledge that the idea of high quality service is quickly evolving. Mobile device usage, web shopping and social media are reshaping service expectations and shopping preferences for both personal and business consumers. The world is changing. Consumers are changing. We as an industry must be changing, too.

In 2015, we challenged ourselves and our agents to evolve to address these market shifts head-on. The result is a clear vision for the future, one that will help us transform and modernize as a company.

In 2016, we’ll continue to make focused investments and grow areas of the business that hold the most untapped potential, especially in Commercial Lines. We’ll also begin to invest in technology that supports an easier way of doing business digitally for both our agents and policyholders.

I’m excited about what the future holds for Grange. Thank you to our more than 5,000 agent partners and 1,400 associates for being a part of the journey forward.

John Ammendola

President & Chief Executive Officer

financial Report

While 2015 was a challenging year in many ways, these results show that our portfolio of insurance products and financial discipline continue to deliver solid results. Our strong financial position provides

us with the ability to invest in our business and support the needs of our agents and policyholders into

the future.

GRANGE ENTERPRISE P&C

FINANCIAL REPORT*

Assets

Cash and Short Term Investments

Bonds (at amortized cost)

Stocks (at market value)

Real Estate (at cost less accumulated depreciation)

Floating Rate Bank Loans

Other Invested Assets

Securities Lending Reinvested Collateral Assets

Accrued Investment Income

Premiums in Course of Collection

Electronic Data Processing Equipment (at cost less accumulated depreciation)

Federal Income Tax Receivable

Net Deferred Tax Asset

Other Miscellaneous Assets

Total Assets

Liabilities and Policyholders’ Surplus

Unearned Premiums

Reserve for Losses

Reserve for Loss Adjustment Expense

General Expenses Payable

Payable for Securities Lending

Other Liabilities

Total Liabilities

Policyholders’ Surplus

Total Liabilities and Policyholders’ Surplus

Statement of Income and Surplus 2015

Premiums Earned

Losses and Loss Adjustment Expense Incurred

Other Underwriting Expenses Incurred

Net Underwriting Gain

Net Investment Gain

Other Income Less Other Expense

Dividends to Policyholders

Income Before Federal Income Taxes

Federal Income Taxes Incurred

Net Income

Other Surplus Changes

Change in Policyholders’ Surplus

Policyholders’ Surplus — January 1

Policyholders’ Surplus—December 31

$45,062,006

1,413,822,238

401,803,815

106,930,582

57,929,249

53,229,553

39,791,121

14,024,848

237,940,960

2,750,118

12,433,946

49,223,869

17,136,176

$2,452,078,481

$479,738,344

530,474,125

143,554,354

49,354,396

39,791,121

95,460,367

1,338,372,707

1,113,705,774

$2,452,078,481

$1,225,338,352

847,198,581

374,491,527

3,648,244

67,753,091

16,630,181

(3,298,756)

84,732,760

9,472,991

75,259,769

(53,809,278)

21,450,491

1,092,255,283

$1,113,705,774

GRANGE LIFE

FINANCIAL REPORT*

Assets

Cash and Short Term Investments

Bonds (at amortized cost)

Common Stocks (at equity)

Policy Loans

Securities Lending Reinvested Collateral Assets

Accrued Investment Income

Premiums Due and Uncollected

Amounts Due from Reinsurers

Net Deferred Tax Asset

Other Miscellaneous Assets

Total Assets

Liabilities, Capital and Surplus

Policy Reserves

Policy Claims Payable

General Expense Payable

Interest Maintenance Reserve

Securities Valuation Reserve

Payable for Securities Lending

Payable to parent, subsidiaries and affiliates

Funds held under coinsurance

Other Liabilities

Total Liabilities

Total Capital and Surplus

Total Liabilities, Capital and Surplus

Statement of Income, Capital and Surplus 2015

Premium Income

Net Investment Income

Benefits Paid to Policyholders

Operating Expenses

Loss Before Federal Income Taxes

Federal Income Taxes Incurred

Net from Operations after Dividends to Policyholders & Federal Income Taxes

Net Realized Capital Loss

Net Loss

Other Surplus Changes

Net Change in Capital and Surplus

Capital and Surplus - January 1

Capital and Surplus - December 31

$22,636,303

292,463,937

9,965,251

11,049,922

6,702,589

2,608,663

37,748,479

4,947,813

4,721,102

381,838

$393,225,897

$300,676,214

3,527,398

4,578,758

1,075,189

2,693,373

6,702,589

10,573,350

17,743,371

3,200,580

350,770,822

42,455,075

$393,225,897

$56,690,553

13,345,347

58,240,314

13,052,400

(1,256,814)

105,625

(1,362,439)

(200,558)

(1,562,997)

(12,112,183)

(13,675,180)

56,130,255

$42,455,075

* Balance Sheet — December 31, 2015

Grange Mutual Casualty Group which includes Grange Mutual Casualty Company, Grange Indemnity Insurance Company, Grange Insurance Company of Michigan, Grange Property & Casualty Company, Trustgard Insurance Company, Grange Life Insurance Company, Integrity Mutual Insurance Company and Integrity Property & Casualty Insurance Company. Coverages and discounts described herein may not be available in all states and policies are subject to underwriting guidelines. All life policies are underwritten by Grange Life Insurance Company, Columbus, Ohio, and are subject to underwriting approval. Please contact a local independent Grange agent for complete details on coverages and discounts.